37 x GDE 045 per km x private mileage if employee pays for the cost of petrol. Some company will provide transport allowances and better still petrol card thrown in also.

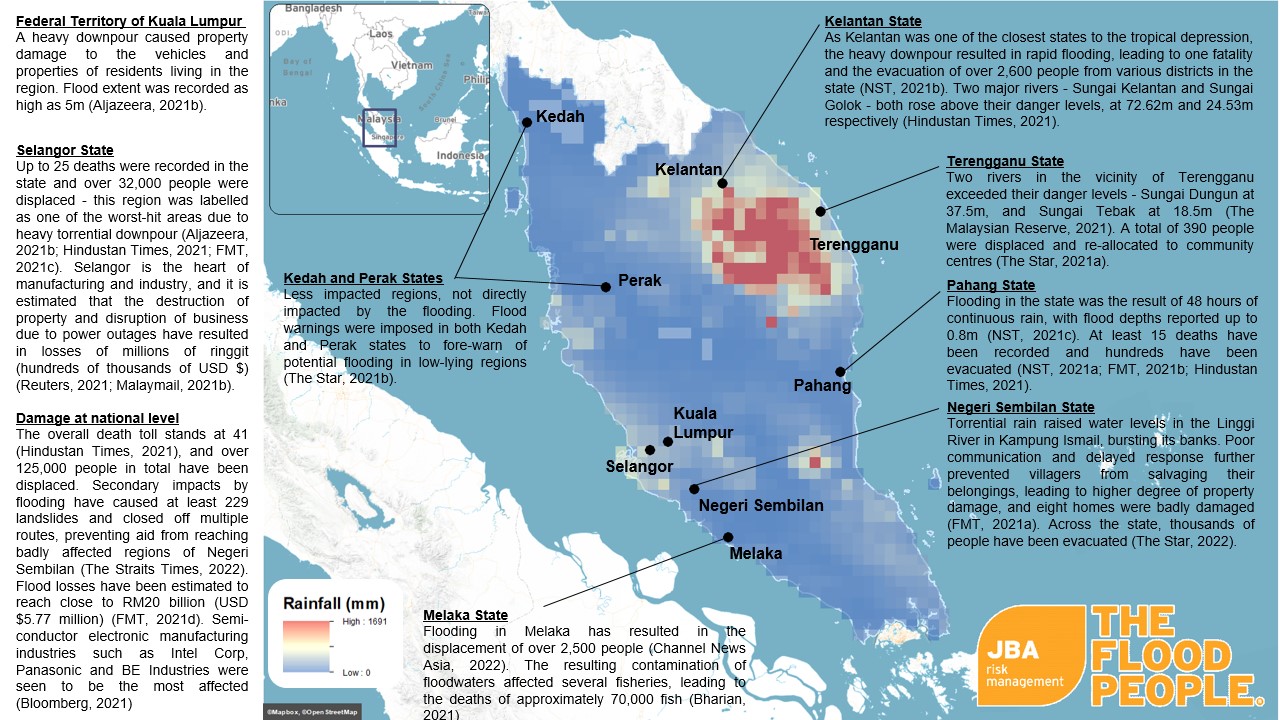

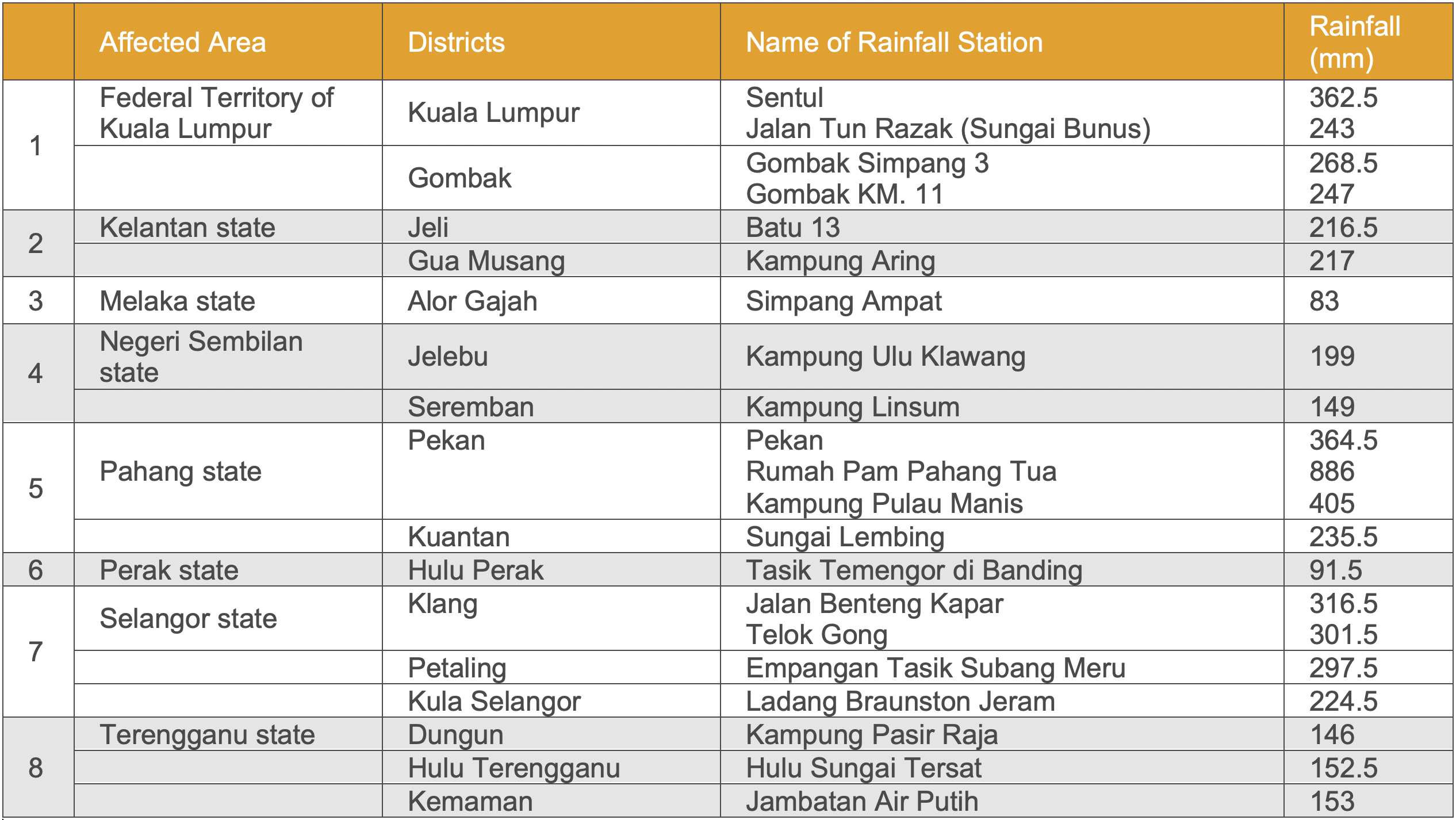

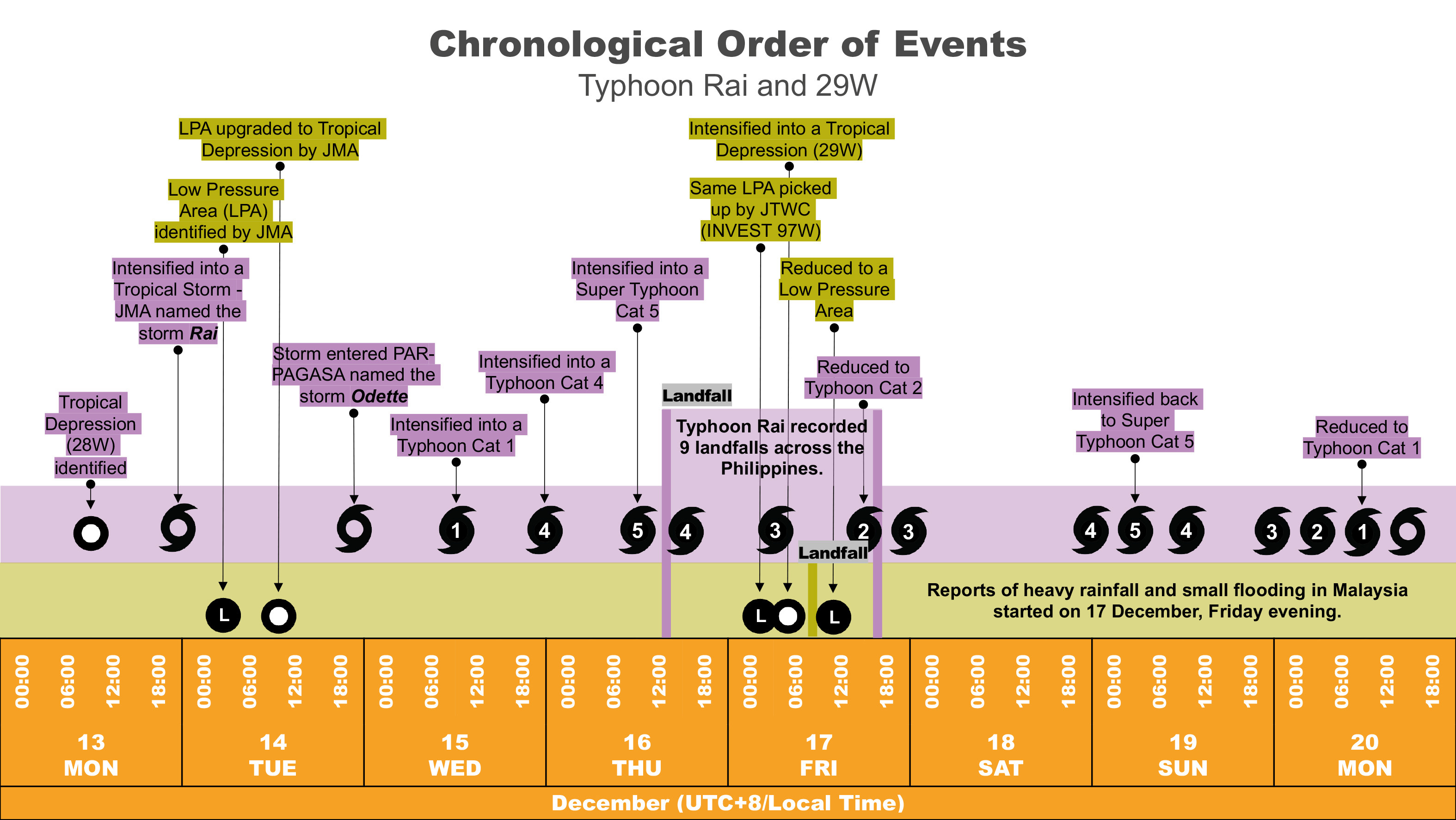

Super Typhoon Rai And South East Asia Floods Jba Risk Management Event Response

In this article Seekers will share.

. 2019 Malaysia Personal Income Tax Exemptions Comparehero. The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate effective at the start of 2022. 66 cents per km for 201718 201617 and 201516.

Why Is The Effective Tax Rate Of High Income Taxpayers. To work out how much you can claim multiply the total business kilometres you travelled by the rate. RM208 RM0 RM256 -RM011 RM218 RM0 July 20 July 26 2019.

When we talk about allowances the top-management side may consider it as an additional payout on top of the regular salary wages. And what is the rate. 1000000 237650 28 A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a.

All-new 2020 Honda City 10L VTEC Turbo Coming to Malaysia Soon. Cents Per Kilometre Car Expenses. I heard GSK also at Rm070km This post has been edited by westernkl.

Employer Mar 15 2021. 4 July 2019 Information has been updated to include tax years 2018 to 2019 and 2019 to 2020 also removed some older details. RM208 RM0 RM253 RM004 RM218.

72 cents per km for 202021 and 202122. Maintenance service wear tear Including major service say 20k KM cost divide back to RMKM. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year.

RM208 RM0 RM257 RM004 RM218 RM0 July 6 July 12 2019. Wapcarmy is the malaysian leading source for you if you are searching for mileage claim calculator malaysia in malaysia. 29 of the respondent companies granted petrol card to the CEOsEDsMDsGMs compared to 121 of the respondent companies which granted petrol card to the senior managers.

What is the best rate for Mileage Claim. Malaysia Airlines Lies And Cheats How Mas Ruined Our Chinese New Year Fourfeetnine. Mileage claim rate singapore 2019 latest news headlinesmileage claim rate singapore 2019 photos and videos about mileage claim rate singapore 2019 from the.

Showed that employed persons in Malaysia increased 22 per cent to 1525 million persons in the fourth quarter of 2019. RM208 RM0 RM254 -RM002 RM218 RM0 July 27 August 2 2019. Read News stories about why mileage claim rate 2017 malaysia.

68 cents per km for 201819 and 201920. RM208 RM0 RM267 RM010 RM218 RM0 July 13 July 19 2019. The rate for 2020-21 and 2021-22 is 72 cents per km for up to 5000 business kms.

The per kilometre car expense claim rate for 2022-23 is to be 75 cents per km. The range like some bros mentioned is between 040 to 080. Cents Per Km is one of the methods you can choose to satisfy the substantiation rules for individuals claiming car expenses as a tax deduction.

Approved mileage rates from tax year 2011 to 2012 to present date. Earn up to 200 bonus points for bookings above usd150. How you use this method.

52 per kilometre driven after that In the Northwest Territories Yukon and Nunavut there is an additional 4 per kilometre allowed for travel. Why mileage claim rate 2017 malaysia latest news headlineswhy mileage claim rate 2017 malaysia photos and videos about why mileage claim rate 2017 malaysia from the. Read News stories about malaysia mileage claim rate 2017 g.

If employer pays for the cost of petrol use the rate of 055 per km instead of 045 per km. The automobile allowance rates for 2019 are. Minimum wages in malaysia remained unchanged at 1200 myrmonth in 2021 from 1200 myrmonth in 2020.

The unemployment rate in this quarter decreased to 32 per cent the lowest unemployment rate. The automobile allowance rates for 2018 are. Read News stories about mileage claim rate singapore 2019.

Rates are reviewed regularly. The value of benefit derived from an existing car with renewed COE is computed as follows. Last years RM 12 per KM now unlimited if drive company car normally i heard RM09 or RM 1 per km is a norm.

Pin On Leadership. Mileage claim rate singapore 2019. Car with Renewed COE.

It also presents details like the name and address of the physician date claimants starting and ending destination address and round trip miles. S025ctskm for those who are given monthly transport allowance and s035ctskm for those who are not. 47 with a value of RM142 trillion at.

August 3 August 9 2019. May 25 2017 0932 PM. Overall year 2019 Malaysias economy registered a growth of 43 per cent 2018.

The average car mileage reimbursement provided to all levels of employees was RM064 per km while the average motorcycle mileage reimbursement was RM035 per km. Rates for fuel charges have been updated for 2021 to 2022. April 5 2011.

Malaysias export of goods in the fourth quarter 2019 registered a decline of 33 per cent to RM2579 billion compared to RM2668 billion in the same period last year. Beginning on january 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be taxpayers also cannot claim a deduction for moving. Gsa is updating the mileage reimbursement rate for privately owned automobiles poa airplanes and motorcycles as required by statute.

Malaysia Mileage Claim Rate 2017. 2019 Honda CITY E 15. Penang Malaysia sometime KL.

20182019 Malaysian Tax Booklet 22 Rates of tax 1. Wonder if you guys travel for for company business by own car Do you claim mileage. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess.

2021 irs standard mileage rate. I hear something as ridiculous as RM020km this one based on current fuel price just enough to cover petrol only while i. However depending on the type of allowance some LHDN tax deductions are applicable and you can meet both top-management and employees expectations.

The per kilometre car expense claim rate for 2022-23 is 78 cents per km. This mileage reimbursement form presents the claim number employee and employer names and date of the accident. On 442011 at 1032 PM Quantum said.

58 per kilometre for the first 5000 kilometres driven. 55 per kilometre for the first 5000 kilometres. Statement On Reimbursement Of Mileage Costs Finalised Tax Alert August 2018 Deloitte New Zealand.

Beginning january 1 2021 the irs standard mileage rate for personal car use will be 56 cents per mile for business use a decrease of 15 cents 16 cents per mile for medical and moving mileage a decrease of 1 cent and 14 cents per mile for.

Super Typhoon Rai And South East Asia Floods Jba Risk Management Event Response

Malaysia Airline Buy Extra Baggage Hotsell 60 Off Www Ingeniovirtual Com

Malaysia Airline Buy Extra Baggage Hotsell 60 Off Www Ingeniovirtual Com

Malaysia Airlines Baggage Fees Policy And Terms Updated 2022

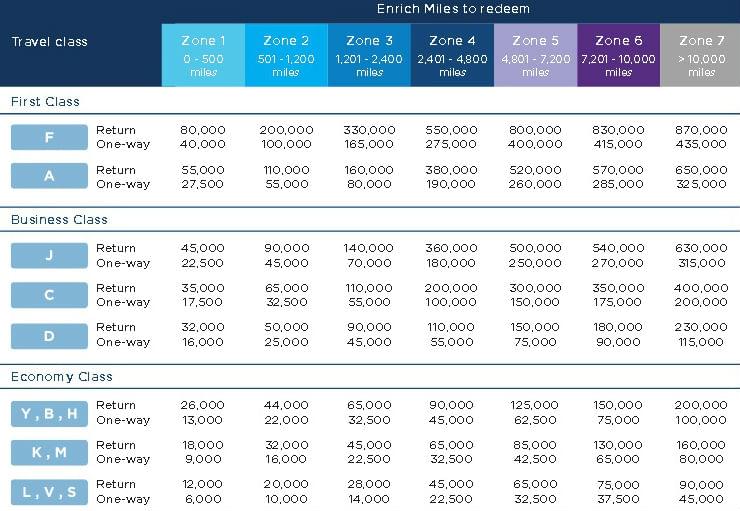

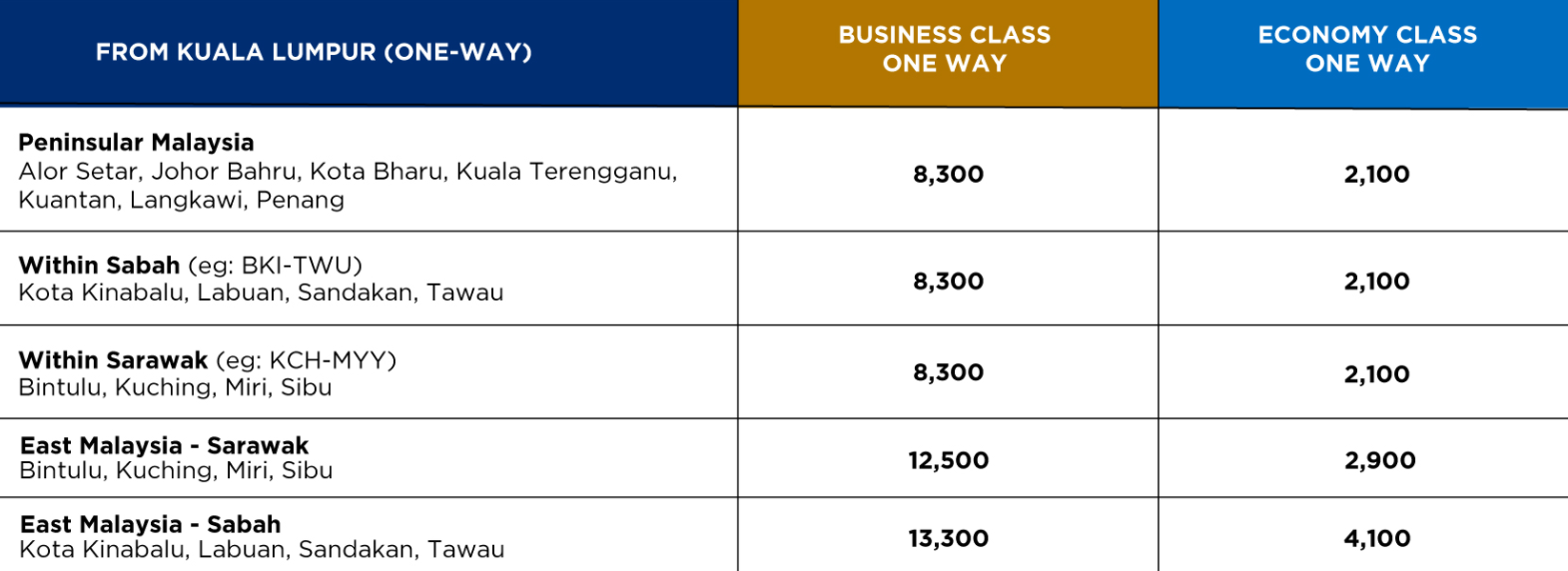

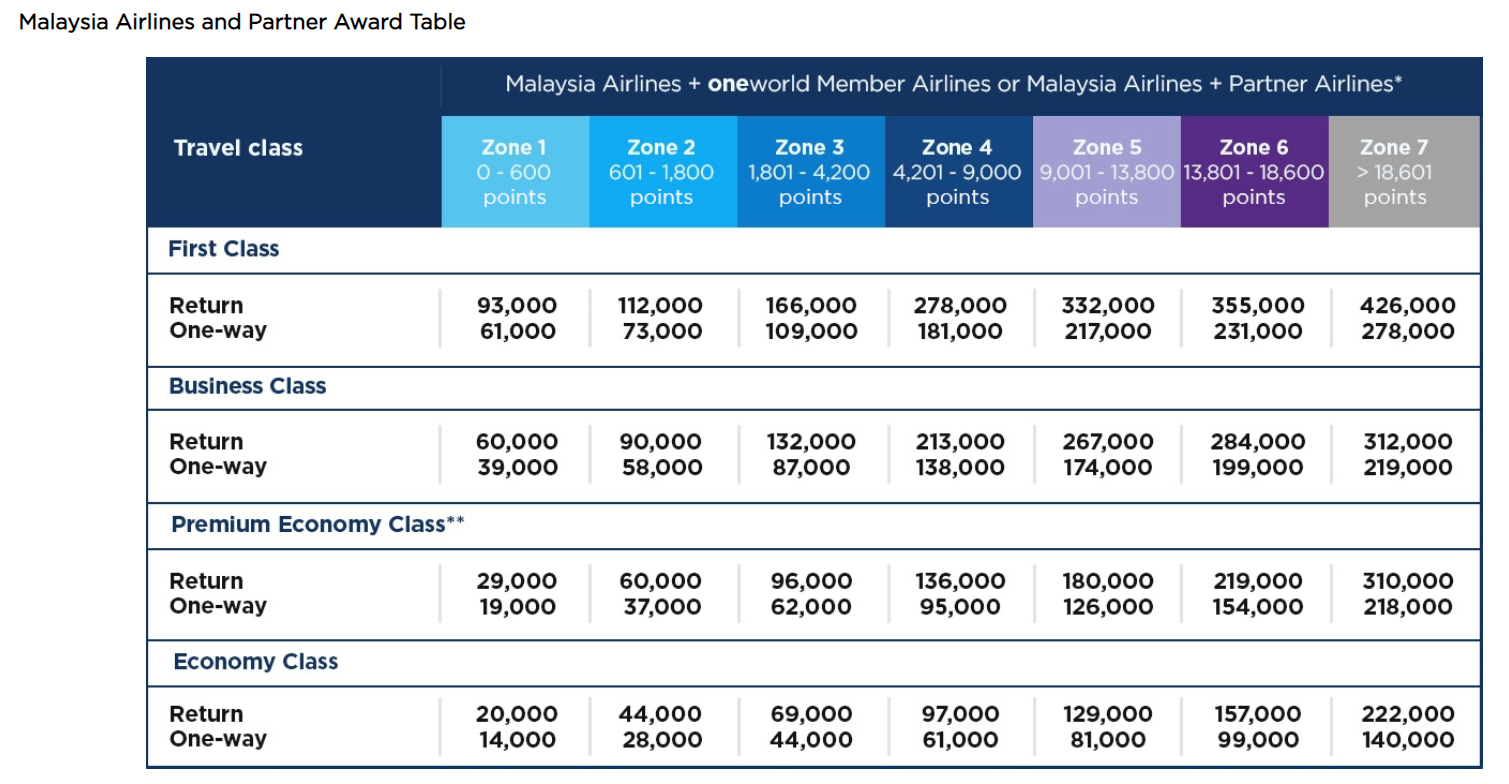

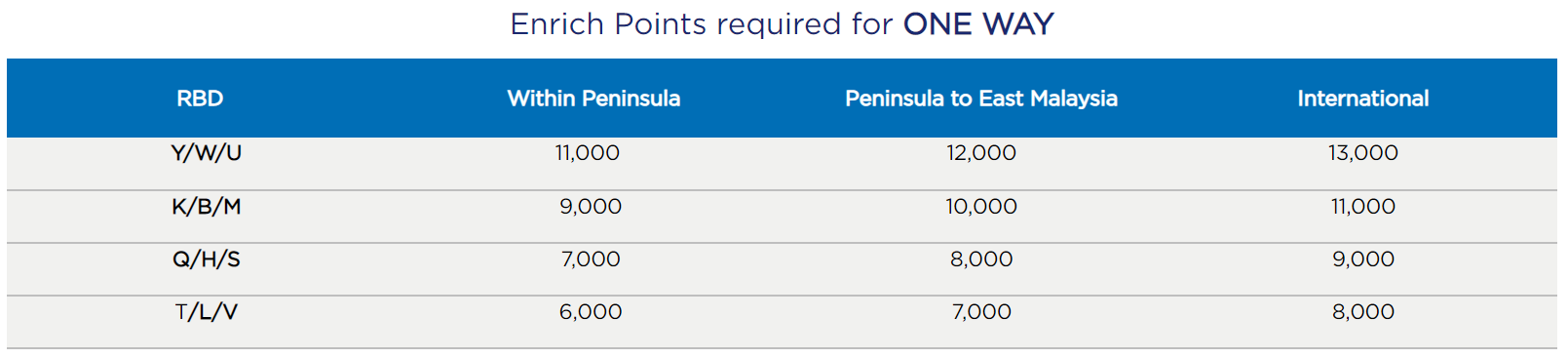

How To Use Malaysia Airlines Enrich Points The Points Guy

How To Use Malaysia Airlines Enrich Points The Points Guy

Malaysia Airline Buy Extra Baggage Hotsell 60 Off Www Ingeniovirtual Com

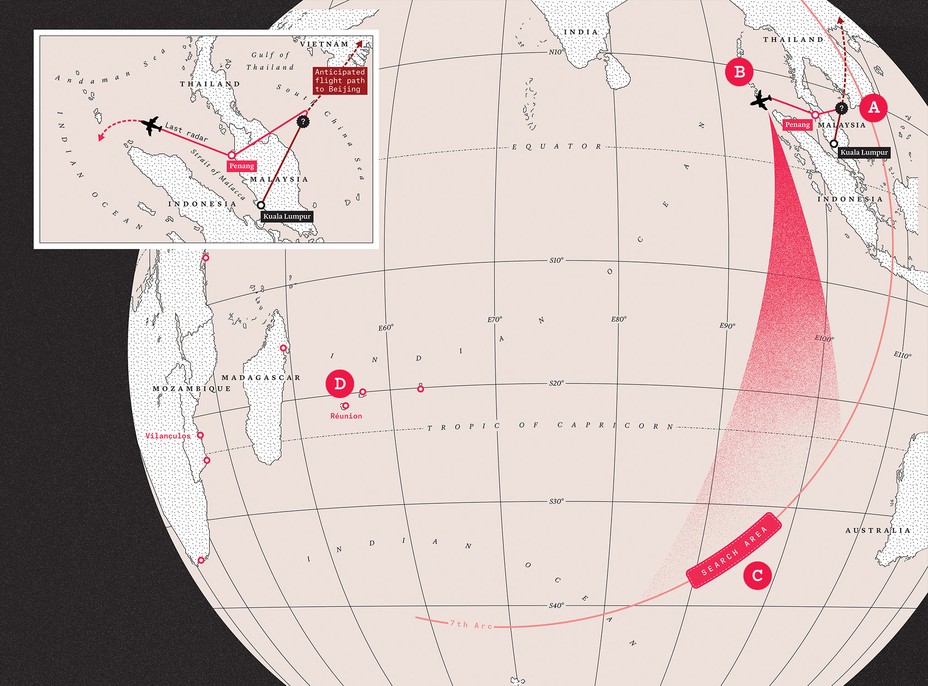

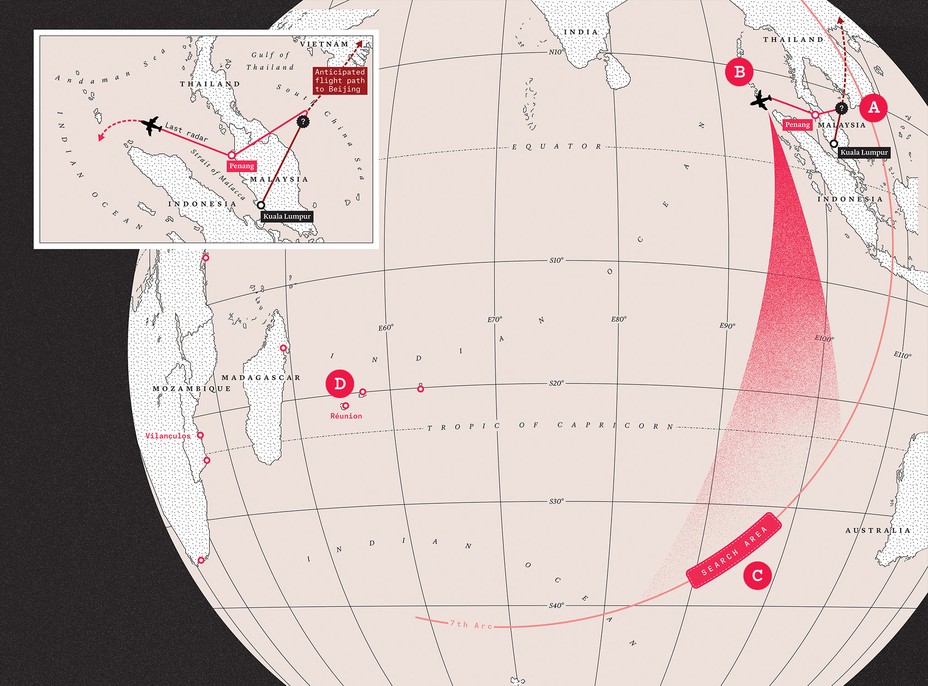

Satellite Photo Of Debris From Missing Plane

Malaysia Airline Buy Extra Baggage Hotsell 60 Off Www Ingeniovirtual Com

Malaysia Airline Baggage Outlet Store Up To 66 Off Agrichembio Com

New 2022 Irs Standard Mileage Rates

How To Use Malaysia Airlines Enrich Points The Points Guy

Super Typhoon Rai And South East Asia Floods Jba Risk Management Event Response

Energies Free Full Text Electric Vehicles In Malaysia And Indonesia Opportunities And Challenges Html

What Car Do You Drive And Do You Recommend It R Malaysia

How To Use Malaysia Airlines Enrich Points The Points Guy

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

Malaysia Airlines Flight Mh370 Where Is It The Atlantic